- #MY BUSINESS ACCOUNT CANADA REVENUE AGENCY FOR FREE#

- #MY BUSINESS ACCOUNT CANADA REVENUE AGENCY UPDATE#

- #MY BUSINESS ACCOUNT CANADA REVENUE AGENCY FULL#

- #MY BUSINESS ACCOUNT CANADA REVENUE AGENCY CODE#

Register today for the CRA's online services You can go paperless with all the returns you file and payments you make to the CRA. You can access information about your company's accounts-all online, all at your fingertips.

#MY BUSINESS ACCOUNT CANADA REVENUE AGENCY FOR FREE#

He earns cash back on purchases using KOHO, monitors his credit score for free using Borrowell, and earns interest on savings through EQ Bank.Home Canada ca taxes Business online E-services for Businesses - Canada His top investment tools include Wealthsimple and Questrade. His writing has been featured or quoted in The Globe and Mail, Winnipeg Free Press, Wealthsimple, Financial Post, Toronto Star, Credit Canada, MSN Money, National Post, CIBC, and many other personal finance publications. Enoch has a passion for helping others win with their personal finances and has been writing about money matters for over a decade. in Agricultural Economics from the University of Manitoba and a Doctor of Veterinary Medicine degree from the University of Ibadan. He has a master’s degree in Finance and Investment Management from the University of Aberdeen Business School (Scotland) and has completed several courses and certificates in finance, including the Canadian Securities Course.

#MY BUSINESS ACCOUNT CANADA REVENUE AGENCY FULL#

You should now have full access.įor a free CRA Business My Account, you need to follow similar steps, except that you will also be required to enter your business number.

#MY BUSINESS ACCOUNT CANADA REVENUE AGENCY CODE#

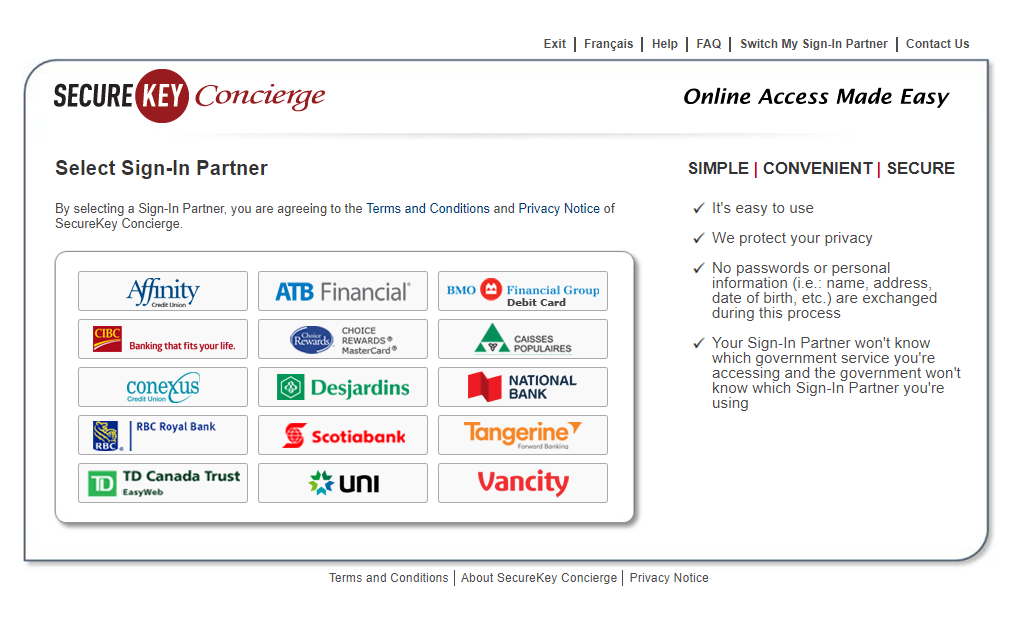

Upon receipt of the security code, log in as usual through the Sign-in Partner and enter the security code when prompted. When you have gathered the information above, proceed to the CRA My Account web page here.įor this option, you need to log in via one of the listed financial institutions using your normal log-in details.Īs I mentioned for Option 1, you will also be required to have your social insurance number, date of birth, postal code, and last two tax returns readily available.Ī CRA security code will be mailed to you as well to enable full access to My Account. It will require you to enter an amount you have entered on one of these returns. for the current year and the previous one. To start, make sure you have the following information available: Registering a CRA My Account for Individuals If you have a business, the account can allow you to access lots of information relating to your business including tax returns for GST/HST, payroll deductions, corporate income tax, excise duty, excise tax, information returns, and lots more. Related: TurboTax: Filing Your Tax Return The Easy Way in Canada Benefits for Business Accounts Authorize a representative, and much more!.View your account balance and statement of account.Apply for direct deposit to your bank account.View your disability tax credit, if applicable.Use the “Auto-fill my return” service when filing your tax return.

#MY BUSINESS ACCOUNT CANADA REVENUE AGENCY UPDATE#

Update personal information including your address, phone number, marital status, and banking information.View your GST/HST credit, if applicable.View your Home Buyers’ Plan (HBP) and Lifelong Learning Plan statements of account.Check your RRSP deduction limit and TFSA contribution room.Apply for and view your child benefits such as the Canada Child Benefit.View/print your tax information including T4, T4A, T4A(P), T4E, T4(OAS), T5, etc.View/print your income tax returns and notice of assessments (current and prior years).The information and benefits you can access directly via your account will vary depending on the type of account. It is a much easier way to get your information than having to call CRA and waiting to speak (sometimes for very long) to a representative. Registering a CRA My Account for IndividualsĮxcept for when the website is undergoing daily maintenance, the online My Account service is pretty much always available and can be accessed 21 hours a day, 7 days a week.Benefits for Individual CRA My Accounts.

0 kommentar(er)

0 kommentar(er)